Ever wondered what's the buzz around USDIQD stock? If you're diving into the world of trading or just curious about market sentiment, you're in the right place. USDIQD stock has been making waves, and understanding its sentiment can be a game-changer for your investment strategy. Let's break it down and see why everyone's talking about it.

Market sentiment isn't just a fancy term; it's the heartbeat of the stock market. It reflects how investors feel about a particular stock, and in this case, USDIQD is no exception. Whether you're a seasoned trader or a newbie, grasping the sentiment behind USDIQD can help you make smarter financial decisions.

Now, before we dive deep into the sentiment of USDIQD stock, let's set the stage. The stock market is a rollercoaster, and understanding the sentiment can help you navigate the ups and downs. So, buckle up as we explore what makes USDIQD tick and how you can capitalize on it.

Read also:Vegamoviescom Bollywood Your Ultimate Destination For Bollywood Entertainment

Understanding USDIQD Stock

First things first, what exactly is USDIQD stock? It's not just another ticker symbol; it represents a unique investment opportunity in the financial markets. USDIQD is tied to the performance of the U.S. Dollar Index, making it a key player in the forex market. Investors watch this stock closely because it offers insights into currency movements and economic health.

Let's get into the nitty-gritty of what USDIQD stands for. This stock tracks the value of the U.S. Dollar against a basket of major currencies. Why does this matter? Well, if the dollar strengthens, USDIQD tends to rise, and vice versa. It's like a barometer for the dollar's performance on the global stage.

Why USDIQD Matters in Today's Market

In today's volatile market, USDIQD plays a crucial role. It's not just about the dollar; it's about global economic trends. When investors are nervous, they flock to the dollar as a safe haven, driving USDIQD higher. Conversely, when confidence is high, they might move away from it.

- USDIQD acts as a hedge against currency risk.

- It provides diversification for investors' portfolios.

- Its performance can signal broader economic trends.

Current Sentiment Analysis of USDIQD Stock

So, what's the sentiment right now? Let's break it down. As of recent reports, USDIQD has been showing mixed signals. Some analysts are bullish, pointing to the dollar's resilience amid global uncertainty. Others, however, are cautious, citing potential headwinds from inflation and interest rate hikes.

Here's the kicker: sentiment isn't static. It shifts based on news, economic data, and geopolitical events. For instance, if there's a major announcement from the Federal Reserve, you can bet USDIQD will react. That's why staying informed is crucial.

Factors Influencing USDIQD Sentiment

Several factors play into the sentiment of USDIQD stock. Let's take a look at some of the big ones:

Read also:Iribitari Gal Live Action Exploring The Adaptation Of A Beloved Manga

- Economic Indicators: GDP growth, unemployment rates, and inflation numbers can all impact sentiment.

- Interest Rates: Changes in Fed policy can send ripples through the market, affecting USDIQD.

- Global Events: Political instability or trade tensions can sway investor sentiment.

Historical Performance of USDIQD Stock

To understand the current sentiment, it helps to look at the past. USDIQD has had its moments of glory and setbacks. Over the last few years, it's shown resilience, especially during times of market stress. This historical context gives us clues about how it might behave in the future.

Let's check out some key milestones:

- In 2020, USDIQD surged as investors sought safety amid the pandemic.

- 2021 saw more volatility, with the stock oscillating based on vaccine rollouts and economic recovery.

- 2022 brought new challenges, with inflation and rising rates affecting sentiment.

Lessons from History

History doesn't repeat itself, but it often rhymes. By studying past performance, we can anticipate future trends. For instance, if USDIQD rallied during previous economic downturns, it might do so again. However, new factors like digital currencies and geopolitical shifts could alter the script.

Investor Perception and Market Behavior

How do investors view USDIQD? Perception is reality in the stock market. Many see it as a defensive play, offering stability when other assets falter. Others view it as a speculative opportunity, betting on short-term movements.

Market behavior also plays a role. When fear dominates, USDIQD tends to gain favor. But when greed takes over, investors might overlook it in favor of riskier assets. Understanding these dynamics can help you position yourself accordingly.

Common Investor Misconceptions

Let's clear up some misconceptions. Some investors think USDIQD is only for forex traders or that it's too complex for the average person. Not true! Anyone can benefit from understanding its role in the market. Plus, with the right tools and knowledge, it's easier than ever to get involved.

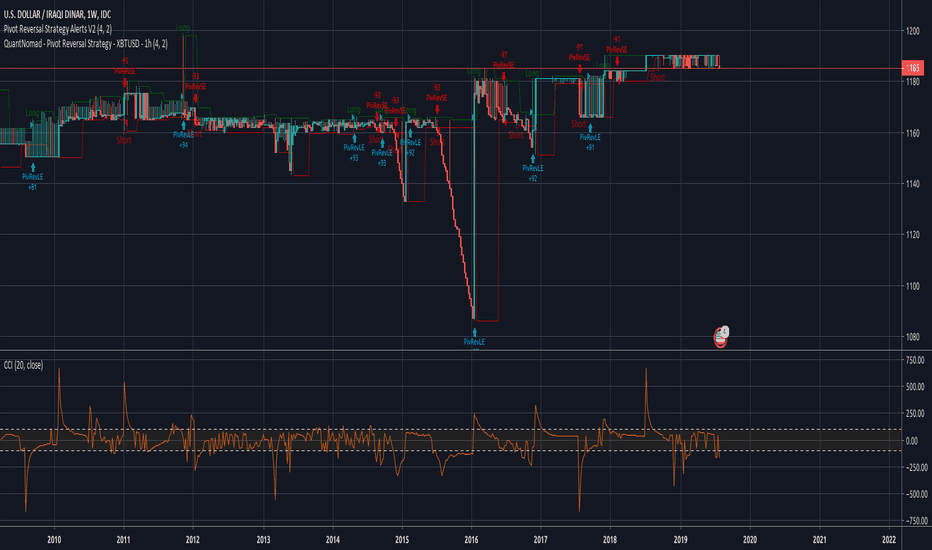

Technical Analysis of USDIQD Stock

For the tech-savvy investors out there, let's dive into the charts. Technical analysis can provide valuable insights into USDIQD's sentiment. By examining patterns, trends, and indicators, we can predict future movements.

Here are some key takeaways:

- USDIQD often forms support and resistance levels based on historical prices.

- Moving averages can help identify the overall trend.

- Oscillators like RSI and MACD can signal overbought or oversold conditions.

Using Technicals to Gauge Sentiment

Technical analysis isn't just about lines on a chart; it's about understanding investor psychology. When the charts show a strong uptrend, it usually means sentiment is positive. Conversely, a downtrend might indicate pessimism. By combining technicals with fundamental factors, you can get a clearer picture of USDIQD's sentiment.

Fundamental Analysis of USDIQD Stock

Now let's shift gears to fundamentals. This involves looking at the economic and financial factors that drive USDIQD. It's like peeling back the layers of an onion to uncover what makes the stock tick.

Here are some fundamental factors to consider:

- The strength of the U.S. economy compared to others.

- Monetary policy decisions by central banks.

- Global trade dynamics and currency flows.

How Fundamentals Shape Sentiment

When the fundamentals are strong, sentiment tends to follow. For example, if the U.S. economy is booming, USDIQD is likely to benefit. On the flip side, if there are signs of weakness, sentiment might sour. By keeping an eye on these factors, you can stay ahead of the curve.

Expert Opinions on USDIQD Sentiment

What do the experts say? Analysts and economists often weigh in on USDIQD's sentiment. Some are bullish, citing the dollar's global dominance. Others are bearish, pointing to potential risks like debt levels and trade imbalances.

Here's the thing: expert opinions aren't always right, but they can provide valuable perspectives. It's up to you to evaluate the evidence and form your own opinion. Just remember, sentiment is subjective, and what one expert sees might differ from another.

Consensus vs. Contrarian Views

There's always a debate between consensus and contrarian views. The majority might think USDIQD is poised for growth, while a few contrarians argue it's overvalued. Which side is right? That's the million-dollar question. As an investor, it pays to consider both sides and make an informed decision.

Future Outlook for USDIQD Stock

So, what's next for USDIQD? The future is uncertain, but we can make educated guesses based on current trends. If the dollar continues to strengthen, USDIQD could see more upside. However, if global conditions shift, it might face headwinds.

Here's what to watch for:

- Geopolitical developments that could affect currency markets.

- Monetary policy changes from major central banks.

- Emerging technologies that could disrupt traditional finance.

Preparing for the Future

Investing in USDIQD is all about preparation. Stay informed, diversify your portfolio, and be ready to adapt. Whether you're bullish or bearish, having a strategy in place can help you navigate the market's twists and turns.

Conclusion: What Does This Mean for You?

In conclusion, the sentiment of USDIQD stock is a complex tapestry woven from economic data, market behavior, and investor psychology. Understanding it requires a combination of technical and fundamental analysis, as well as a dash of intuition.

So, what should you do next? Start by educating yourself on the factors that drive USDIQD. Follow the news, analyze the charts, and listen to expert opinions. Most importantly, don't be afraid to ask questions and seek advice.

And hey, don't forget to share this article with your fellow investors! The more we learn together, the better equipped we'll be to navigate the stock market. Now go out there and make some smart moves!

Table of Contents

- Understanding USDIQD Stock

- Current Sentiment Analysis of USDIQD Stock

- Historical Performance of USDIQD Stock

- Investor Perception and Market Behavior

- Technical Analysis of USDIQD Stock

- Fundamental Analysis of USDIQD Stock

- Expert Opinions on USDIQD Sentiment

- Future Outlook for USDIQD Stock

- Conclusion: What Does This Mean for You?